This week, AI chipmaker Cerebras Methods introduced that it raised $1 billion in recent capital at a valuation of $23 billion — a virtually threefold improve from the $8.1 billion valuation the Nvidia rival had reached simply six months earlier.

Whereas the spherical was led by Tiger World, an enormous a part of the brand new capital got here from one of many firm’s earliest backers: Benchmark Capital. The distinguished Silicon Valley agency invested at the very least $225 million in Cerebras’ newest spherical, in response to an individual acquainted with the deal.

Benchmark first guess on 10-year-old Cerebras when it led the startup’s $27 million Sequence A in 2016. Since Benchmark deliberately retains its funds beneath $450 million, the agency raised two separate autos, each known as ‘Benchmark Infrastructure,’ in response to regulatory filings. In line with the particular person acquainted with the deal, these autos have been created particularly to fund the Cerebras funding.

Benchmark declined to remark.

What units Cerebras aside is the sheer bodily scale of its processors. The corporate’s Wafer Scale Engine, its flagship chip introduced in 2024, measures roughly 8.5 inches on either side and packs 4 trillion transistors right into a single piece of silicon. To place that in perspective, the chip is manufactured from practically a complete 300-millimeter silicon wafer, the round discs that function the muse for all semiconductor manufacturing. Conventional chips are thumbnail-sized fragments minimize from these wafers; Cerebras as an alternative makes use of nearly the entire circle.

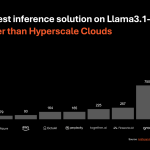

This structure delivers 900,000 specialised cores working in parallel, permitting the system to course of AI calculations with out shuffling information between a number of separate chips (a serious bottleneck in standard GPU clusters). The corporate says the design permits AI inference duties to run greater than 20 instances quicker than competing programs.

The funding comes as Cerebras, primarily based in Sunnyvale, Calif., good points momentum within the AI infrastructure race. Final month, Cerebras signed a multi-year settlement price greater than $10 billion to offer 750 megawatts of computing energy to OpenAI. The partnership, which extends by 2028, goals to assist OpenAI ship quicker response instances for complicated AI queries. (OpenAI CEO Sam Altman can be an investor in Cerebras.)

Techcrunch occasion

Boston, MA

|

June 23, 2026

Cerebras claims its programs, constructed with its proprietary chips designed for AI use, are quicker than Nvidia’s chips.

The corporate’s path to going public has been difficult by its relationship with G42, a UAE-based AI agency that accounted for 87% of Cerebras’ income as of the primary half of 2024. G42’s historic ties to Chinese language know-how firms triggered a nationwide safety evaluation by the Committee on Overseas Funding in the USA, bumping again Cerebras’ preliminary IPO plans and even prompting the outfit to withdraw an earlier submitting in early 2025. By late final yr, G42 had been faraway from Cerebras’ investor record, clearing the best way for a recent IPO try.

Cerebras is now getting ready for a public debut within the second quarter of 2026, in response to Reuters.